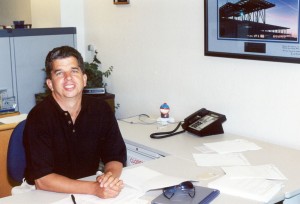

When we first moved in together, I was working under my own shingle, with Stock International Law written on it, in the home office at Le Tahu, this blended family’s first home outside Paris.

Okay, we can’t argue with the obvious: being a corporate lawyer is not very sexy, and being a lawyer often evokes a certain disdain. Just in case I had not noticed this regrettable fact, Nick was kind enough to give his father a daily calendar of lawyer jokes for Christmas one year! I threw it out, discretely, after a couple of months.

I spend much of my professional time negotiating and drafting deals. This is commercial or financial in its goal, but doing deals is much more people-based than you realize. Especially when different cultures are involved, it’s very stimulating people work. So my preference is to do deals, and have them involve different cultures if possible. In the modern business world, that happens a lot, and work is good.

I hung out my own shingle at different times during our years together, working independently. At other times I worked for a law firm, and at others in-house for public companies. Each role had its ups and downs.

Taken the same day, I think, this time from a different angle. The three burgundy volumes on the left of the right bookcase’s top shelf were the binders for Bristol Myers Squibb’s purchase of the Upsa Group of companies in France.

The most enjoyable deal under my first shingle was done in 1995 and involved representing the interests of friends and long-term clients who were the CEO and VPs of a French start-up being acquired by a US multinational. The VC owners of their start-up just wanted to get the sale done and the money in their pockets: typical seller motivation!

The management team had a vision for the future of their company which they sought to have at least partially implemented under new ownership, and for themselves to be taken care of if their company being acquired had adverse consequences on their employment. It’s a common enough scenario. What was different in this case was that not only did the acquirer and the acquired each have their own lawyers, management did too, me. A different and enjoyable role, looking after my friends’ interests.

Things deteriorated in 1996. For whatever reason, I wasn’t finding enough work. By the summer, I was very hungry. The very French law firm of Lefèvre Pelletier needed help analyzing a portfolio of distressed commercial real estate for a US investment bank. That the firm had no US qualified lawyers of its own was itself odd: if it wanted to play ball with big boys like this US investment bank, it should have had US qualified lawyers. I was worried, guessing that the absence of an existing US lawyer reflected some sort of French chauvinism. Did you ever notice that the word describing nationalist xenophobia is itself French?! Hunger won the day, however, and I duly analyzed and summarized large portions of this substantial portfolio.

Not a lot changed in sixteen months! This was in my larger and more pleasant office in La Bellanderie,.

I had very little left to do for the firm when I took off with Nick and Tom to see mum for a weekend in July. She was clearly on her last legs. I could tell. I wanted to stay that week, or rather ferry Nick and Tom home and then come back to be with her. The firm implored me to come back and finish what little was left, told me that it would definitely lead to more work, that sort of thing.

I left mum on the Sunday, she died on the Wednesday and Lefèvre Pelletier took me out to lunch a couple of weeks later to inform me that they no longer would require my services. I wasn’t surprised. They were happy: their work had been completed on schedule, and they didn’t need any anglo-saxon lawyers anyhow. I am embarrassed at times by how ugly law firms can be.

Most of WSGR’s Corporate Finance Group on my last day at the firm in September 2000. Left to right, the then partners in the Group were John Fore (sort of in the middle, with beard), John Mao (third from right) and Michael Occhiolini (far right). Andy Hirsch missed the photo op. Most of the people in this photo had, by 2008, moved on in one way or another. John, John, Michael and Andy are still there, of course,

* * *

Cut to California. I arrived there with two French clients, courtesy of Karim Medjad. Each was a high-tech company which wanted to be based at ground zero for high-tech companies, Silicon Valley. I did a classic Series A financing round for each, helping them accustom themselves to the business world in California. But finding work under my own shingle in a place where I was both inexperienced and almost unknown was not possible.

So I got a job, spending two and a half years as Special Counsel to the Corporate Finance Group at WilsonSonsini Goodrich & Rosati, the powerhouse high-tech law firm based in Palo Alto. This was life at the hub of California’s Silicon Valley, at the time of the internet bubble, and a more stimulating corporate law firm would be hard to imagine. John Fore, a friend from my first job out of law school in New York (other friends from Kronish Lieb, now Cooley’s New York office, can be seen here), runs the WSGR Corporate Finance Group and was kind enough to hire me.

The good side of WSGR was the firm’s entrepreneurial clients. For example, a telecoms equipment client which started out with nothing in late 1997 had attracted Kleiner Perkins, one of the biggest name VCs, by the end of 1998. I spent thousands of hours from 1998 through 2000 doing, how many, four, separate financing rounds for that client, and then helping on its IPO. A few guys with good engineering instincts and a generous dose of marketing savvy were getting rich. It was a wild ride.

The bad side of WSGR was the nasty people there. One in particular took a dislike to me, something I always have trouble understanding! I had tried to offer Selim Day a little advice when he was conspicuously blowing a big deal. He did end up blowing it, by the way, closing it on a hand-written contract that was a complete mess and made his firm look ridiculous. Only the other side’s dignified tolerance of his excesses permitted that cock-up to be fixed, and then only months later.

When I offered him help, because this was a type of deal I knew much more about than he, he was oddly quiet in response, but had no other reaction at the time. Then he started badmouthing me to the client concerned and other lawyers in the firm, manipulating them and undermining me. I deduced that he didn’t want anyone knowing of any weakness on his part.

I’m told that he lied to undermine others in later years, even John himself, his erstwhile protector, and another of John’s closer colleagues. Several years later, one of his peers in the firm’s compensation committee described Selim as its “most reviled” partner. He’s still there, still working for the firm that rewrote the book on the practice of corporate law. Maybe he’s read that book by now!

* * *

Mike Ross, Atmel’s then General Counsel, at his desk in March 2001. The framed photograph on the wall is of the Atmel head office just of 101 in San Jose under construction. Mike had managed that project for the Company.

I moved on in late 2000 to become Chief Corporate Counsel of Atmel Corporation, a chip company in San Jose, working for Mike Ross, the company’s able and practical General Counsel. I had been thinking about working in-house for a while. The idea of participating in the business appealed to me, and there wasn’t much of that in law firms. In firms, one participated in the rare extraordinary transactions rather than in the business itself.

WSGR was one of Atmel’s principal outside counsel, and before accepting the position I asked the partner who managed the account for the firm for his perspective on the company. “It’s like the UN over there,” he replied, thereby assuring perhaps accidentally that I would take the job offered.

Kelly Nakamura, Atmel’s tax guru, and John Pacuzzi, its contracts guru, in Kelly’s constantly cluttered cubicle in March 2001. John moved to Switzerland for a few years to support Atmel’s activities there, and then returned with a Swiss wife and baby. I don’t know where Kelly went when she left the company soon after I did.

Atmel had and has substantial operations in Europe, Scandanvia and Asia, as well as in the US, making this a perfect position for me, with my preference for working with different cultures. There was a significant Atmel presence in France, which also fitted my experience. I handled a more diverse range of matters than if I had been working in a law firm, running the gamut from joint ventures in each of Taiwan and Norway through commercial licenses all over Asia.

Mike Ross knew that I wanted a General Counsel job like his, and was kind enough to refer to me a headhunter who called him in early 2003 trying to fill such a position. Nice guy, Mike. The headhunter interviewed me over a video link (he was in Dallas), and then sent me for follow-up interviews with his company client in Southern California.

This was a company under construction! But couldn’t they have started with the first four or five letters?!

They worked out pretty well, and I accepted the company’s offer, with a few embellishments, and moved on again. This time, the destination was Newport Beach in sunny and warm Southern California, where I became the first General Counsel of newly-public Mindspeed Technologies, Inc., another chip company.

It was a good job, but the family did not want to move away from Santa Cruz, the company was in a difficult product market, and the job didn’t last long. Neither did the initially high-flying share price, and the options puttered out again. Such is life in the high-tech world. They were very kind when they laid me off, and I was able to take significant time off, reflecting.

* * *

And so it came to pass that in 2005, I went back to working under my own shingle, this time calling the firm EntrepreLaw because I wanted to work with entrepreneurs. In exchange for a more comfortable lifestyle, I offer start-up lawyering for a fraction of the price of my peers in their traditional law firms.

With Jeremy Neuner, NextSpace’s inspiring CEO, at the company’s first birthday party in October 2009. We’re both wearing our NextSpace T shirts. Nick, who also worked there for a while, eventually stole mine!

In addition to start-up law, I handle a bunch of licensing and other tech transactions, as well as commercial financing and M&A deals. At any time, I’m working as a kind of part-time outside general counsel for one or two clients with lots to do.

By 2007, my office was one of a number of comfortable local coffee shops where I could draft and meet clients. Often, the client picked the coffee shop nearest its office. My business development strategy was made up of Google AdWords, online keyword-based advertising, a Linked-In profile, an on-line resume, and a website (www.entreprelaw.com). I went from a Skype office number to no number other than my cell phone, and the tools of my trade became the phone, my laptop and a printer and scanner. That’s it nowadays.

Later, I tried the home office again for a while, but it felt antisocial by this time, and then in 2008 found NextSpace, a coworking space which comprises a whole community of people working alone or almost alone. Home at last!

I could not have imagined any aspect of such an incredibly mobile and flexible professional lifestyle when first starting out in Manhattan in 1983. Then being locked to a desk in a law firm’s office with word processing and a secretary was the only option for a business lawyer. I am lucky enough to be living the future of work, and it is good!